Let’s not beat around the bush: if you want performance you can predict and steer, you need to separate what signals the future from what confirms the past. You’ll use leading indicators to spot momentum early—trial sign-ups, pipeline velocity, or NPS shifts—while lagging indicators validate impact with revenue, churn, and margin. When you blend both in disciplined KPI dashboards, you align actions with outcomes and avoid blind spots, but the real challenge is choosing the right signals for your context…

Key Takeaways

- Leading indicators are predictive, behavior-linked metrics that signal future outcomes; lagging indicators record realized results like revenue and retention.

- Pair leading and lagging indicators to create feedback loops that connect current actions to validated business outcomes.

- Select leading indicators that are controllable, time-bound, thresholded, and tied to strategic goals with clear ownership and intervention plans.

- Use real-time analytics and dashboards to visualize trends, trigger timely actions, and review weekly for correlation with lagging results.

- Regularly audit and refine metrics, ensuring aligned definitions, SMART criteria, and OKR linkage to maintain accountability and relevance.

What Are Business Indicators?

Blueprints for performance, business indicators are statistics that quantify the factors shaping how an organization is doing, turning raw activity into decision-ready insight. You use these metrics to measure what matters, translate signals into actions, and align teams around shared outcomes.

Business indicators fall into practical groups that serve different purposes in decision-making and analysis. You’ll encounter leading indicators that hint at where results are headed, lagging indicators that confirm what already happened, and coincident indicators that describe current conditions. Together, they create a balanced view of performance by pairing prediction, confirmation, and context.

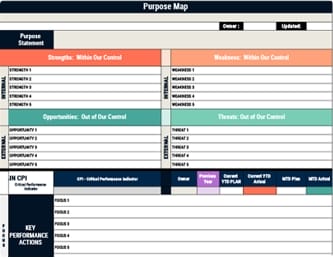

In practice, you track operational and financial metrics, compare them against baselines, and investigate gaps. Then you connect the measures to goals, assign owners, and update cadence, so insights reliably drive better decisions. To turn measurement into execution, translate indicators into daily Key Performance Actions that are observable and coachable, linking them through KPIs to a few mission-critical CPIs.

Leading Indicators Defined

After outlining how indicators frame performance, it’s time to specify what makes some metrics forward-looking. Leading indicators are predictive metrics that signal future performance by reflecting behaviors likely to drive results, letting you adjust tactics before outcomes materialize.

You should track customer acquisition metrics, social media engagement, and average session duration, because shifts in these inputs often precede sales, retention, or pipeline growth.

Use real-time data analysis to detect emerging patterns quickly, then test targeted actions, such as refining offers, reallocating channels, or optimizing content cadence.

Tie each indicator to specific strategic goals, define baselines, and set thresholds that trigger action. When you embed these measures into regular decision-making, you create a feedback loop that links present activities to future performance, improving agility, resource alignment, and accountability. To reinforce execution, connect leading indicators to aligned OKRs and governance rhythms so every layer stays accountable and focused on strategic outcomes.

Lagging Indicators Defined

Rearview clarity matters: lagging indicators are metrics that capture outcomes that have already occurred, letting you verify whether your strategies produced the results you intended over a defined period.

You use these metrics to measure past performance, because they’re grounded in completed transactions and events that provide concrete data. Financial metrics like revenue and profit margins, along with customer retention rates, reveal historical success and expose where execution met or missed targets.

Since the data reflects actual results, you can assess effectiveness with confidence, trace accountability, and validate whether initiatives delivered value.

Actual results let you assess effectiveness, assign accountability, and confirm initiatives truly delivered value.

However, because lagging indicators follow activity, they don’t predict what comes next, so you should pair them with forward-looking signals to build a thorough view of performance and guide timely strategic adjustments.

As seen in companies like Tesla and Spotify, aligning measurement with strategy ensures lagging indicators confirm whether initiatives—such as cross-functional collaboration or user engagement efforts—actually translated into the intended outcomes.

Coincident Indicators and Economic Context

While you can’t forecast with them, coincident indicators tell you what’s happening in the economy right now, giving you a grounded read on current business conditions to inform immediate decisions.

You use them to assess the current state of economic performance, not to predict the next move, because they move in step with the business cycle. Focus on Gross Domestic Product, employment rates, and industrial production, since together they reveal overall economic health and sector momentum.

Track the unemployment rate alongside output to understand labor slack or tightness as growth expands or contracts. When these measures rise together, you’re likely in expansion; when they soften, conditions are cooling.

Use this real-time picture to calibrate staffing, inventory, pricing, and cash management with greater confidence.

Why Both Indicator Types Matter

Knowing what’s happening right now through coincident indicators sets the stage for why you also need both leading and lagging measures to manage performance end to end. You rely on leading indicators to shape predictive performance, because they capture actions you can influence, such as customer engagement metrics, pipeline velocity, and campaign response rates. At the same time, lagging indicators validate results, revealing business performance outcomes like revenue growth, margin, and retention, so you can judge strategy effectiveness. Use both to build a balanced performance framework: lead measures warn you early, letting you adjust tactics before outcomes lock in, while lag measures confirm impact and calibrate targets. This integration strengthens strategic planning, aligns teams around evidence, and enables realistic goal-setting, timely course corrections, and continuous learning. Integrate operational realities and stakeholder input so indicators remain actionable and tied to performance metrics, enabling timely adjustments and a tighter link between strategy and execution.

Selecting Actionable Leading Indicators

How do you choose leading indicators that actually move results instead of just describing activity? Start by selecting indicators tied to controllable behaviors, not vanity stats, so you can act quickly and predict future performance.

Audit current metrics, map them to desired business outcomes, then elevate quantifiable, behavior-based measures—sales calls, website visits, trial sign-ups, or customer engagement metrics—that reliably precede revenue shifts.

Define actionable indicators with clear owner, cadence, and playbook: when the metric dips or spikes, specify what action follows. Avoid circular debates by linking each metric to a direct lever you can pull within days, not months.

For performance tracking, set thresholds that trigger interventions. Review correlations with lagging indicators regularly, keep what predicts, drop what doesn’t, and iterate to sharpen foresight and execution.

To strengthen predictiveness and execution, align leading indicators with process optimization and clear accountability, tying each metric to an owner, cadence, and measurable improvement actions.

Validating Strategies With Lagging Indicators

Because leading indicators are only as good as the outcomes they forecast, you validate your strategy by grounding it in lagging indicators that capture realized performance over defined periods.

Use ARR, customer retention, and margin growth to compare expected targets with actual results, confirming whether your assumptions held. Start with past performance to establish baselines, then analyze trends across quarters to reveal the effectiveness of strategies in marketing and operations.

When lagging indicators conflict with early signals, reevaluate tactics, refine hypotheses, and adjust resource allocation to protect business outcomes. Rely on historical performance data to validate strategies, clarifying which initiatives truly drive durable gains.

Regular tracking supports informed decisions, highlights compounding improvements, and exposes hidden risks, ensuring your execution aligns with measurable, sustainable impact.

To strengthen validation, map these indicators to organizational alignment to ensure both vertical and horizontal cohesion, which is linked to faster revenue growth and higher profitability.

Blending Indicators Into KPI Dashboards

Validated outcomes set the foundation for what you track next, and a well-designed KPI dashboard connects those proven results with the early signals that shape day-to-day decisions.

Validated outcomes anchor what you track, linking proven results to early signals guiding daily decisions.

You should blend leading indicators and lagging indicators in KPI dashboards to create a thorough performance measurement system that links daily actions to business goals. Pair customer engagement metrics with revenue growth, mapping how acquisition, activation, and retention translate into financial outcomes, then set targets and thresholds that trigger timely responses.

Use real-time data visualization to surface trends, highlight variances, and deliver predictive insights that inform weekly adjustments. Review and refresh metrics as strategies evolve, keeping definitions consistent and data sources reliable. Visual management tools like Kanban boards and Andon systems enhance transparency with real-time feedback, enabling quicker responses to issues and fostering accountability.

Finally, align ownership and cadences, so teams act on signals quickly while leadership validates progress against outcomes.

Common Pitfalls and How to Avoid Them

Even with a solid dashboard, you’ll stumble if you treat indicators carelessly, so start by avoiding five common mistakes that quietly undermine performance management.

First, don’t rely only on lagging indicators; they surface performance issues after the fact, delaying corrective action.

Second, tighten vague leading indicators by making them specific, time-bound, and directly tied to business outcomes.

Third, schedule reviews to recalibrate both sets, since shifting goals demand refreshed tracking.

Fourth, analyze correlation between leading and lagging indicators, validating whether early activities truly drive the results you want.

Finally, align definitions and roles across teams to guarantee consistent measurement practices, shared understanding, and clean data.

Taken together, these steps improve strategic decision-making, reduce noise, and keep your measurement system relevant and actionable.

To reinforce this rigor, connect your indicators to OKRs so teams can link leading activities to clear objectives and validated key results across the organization.

Tools and Practices for Reliable Measurement

While your strategy defines what to measure, reliable execution depends on the right tools and disciplined practices that turn raw events into trustworthy insight.

Use product analytics platforms like CleverTap’s Analytics Platform to capture real-time behavior, visualize leading indicators and lagging indicators, and surface performance insights without manual stitching. Build dashboards that balance both types, so tracking indicators connects early signals with outcomes.

Leverage product analytics to link leading signals with outcomes through balanced, real-time dashboards and insights

Review leading indicators such as average session time and activation rates weekly, then validate their correlations to lagging indicators using cohort and funnel analyses.

Adopt measurement practices that uphold SMART criteria for metrics, guarantee data accessibility across teams, and document event definitions to prevent drift.

Schedule metric audits, retire stale measures, and refine thresholds based on observed performance, enabling consistent, data-driven decision-making.

To keep metrics aligned with operations, document processes in a Business Operating System and schedule regular reviews to refine definitions and ensure accountability.

Frequently Asked Questions

What Is the Difference Between Leading and Lagging Performance Indicators?

Leading indicators predict future results, helping you act early to influence outcomes, while lagging indicators report what already happened, confirming whether goals were met.

You track leading metrics like website visits, demo requests, or pipeline velocity to steer strategy, though they’re harder to measure.

You use lagging metrics like revenue, profit, and retention to validate performance.

You should combine both, letting leading indicators guide decisions and lagging indicators verify impact and accountability.

How to Tell if an Indicator Is Leading or Lagging?

Classify it by the question it answers, by the action it enables, by the timing it reflects.

If it predicts what’s likely to happen and you can influence it directly—like ad clicks or demo requests—it’s leading.

If it summarizes what already happened—like quarterly revenue or churn—it’s lagging.

Test causality: increase the candidate leading metric and watch for subsequent movement in the lagging one, validating a consistent, time-ordered correlation.

Is MACD a Leading or Lagging Indicator?

It’s a lagging indicator. You calculate MACD from past prices—the 12-day EMA minus the 26-day EMA—so its signals confirm trends after they start.

When the MACD line crosses above the 9-day signal line, you read it as bullish; a cross below is bearish, but both are reactive.

You should use MACD to validate momentum and spot possible reversals, then pair it with leading indicators or price action to anticipate moves earlier.

Is NPS a Leading or Lagging Indicator?

It’s primarily a leading indicator, because you use NPS to gauge current satisfaction and predict future behavior like retention and referrals.

You track how likely customers are to recommend you, then prioritize fixes and enhancements that should improve growth.

However, you can treat NPS as a lagging indicator when you compare scores over time to evaluate past initiatives, assess whether service or product changes worked, and recalibrate your customer experience strategy accordingly.

Conclusion

As you build your KPI dashboard, treat leading indicators like scout reports and lagging indicators like the final ledger, much like Odysseus steering by stars and landfalls. You’ll forecast with engagement, conversion intent, and pipeline health, then confirm with revenue, margin, and retention. Blend both, add coincident economic cues, and set thresholds, cadences, and owners. Validate assumptions through backtesting, avoid vanity metrics, and audit data quality, so your decisions stay timely, grounded, and predictively reliable.