If you need to turn a struggling business within 24 months, start by spotting early warning signs, validating them with data, and aligning leaders around a clear diagnosis, then move fast to stabilize cash and liquidity while protecting core customers. Build a realistic plan with prioritized initiatives, accountable owners, and weekly routines, optimize operations for margin, and grow revenue without extra ad spend. With disciplined KPIs and stage gates, you’ll know exactly what to fix next—and when.

Key Takeaways

- Stabilize cash immediately with daily cash reporting, 13-week forecasting, cost freezes, term renegotiations, and accelerated collections to buy runway.

- Diagnose root causes with fast, fact-based financial and operational reviews; link gaps to processes, assets, and markets using data and frontline insights.

- Align stakeholders through clear objectives, roles, and cadenced reviews; resolve conflicts quickly and convert commitment into accountable execution.

- Design a sequenced 24-month roadmap connecting short-term liquidity actions to profitability, with KPIs, owners, stage gates, and restructuring priorities.

- Sustain momentum via disciplined operating cadence: daily cash huddles, weekly pipeline and cost reviews, monthly KPI forums, and a Transformation Office.

Recognizing Early Warning Signs of Distress

Although distress can creep in quietly, you can spot it early by watching for patterns that consistently strain the business. Treat persistent cash flow problems, overdue taxes or supplier bills, and unexplained sales declines as early warning signs, because they often signal operational or financial weaknesses that won’t fix themselves.

Track KPIs weekly—operating cash, aging payables, sales conversion, and employee engagement—to see trends, not just snapshots, and escalate when thresholds are breached.

If lenders tighten terms or creditors shorten payment windows, read it as eroding confidence and act fast. Plan timely intervention by protecting liquidity, prioritizing critical payments, communicating clearly with creditors, and stabilizing your team to curb turnover.

Use these insights to select proportional turnaround strategies, matching actions to severity and speed.

Diagnosing Root Causes With Data and Insight

Start with two disciplined passes: a fast, fact-based scan to stabilize cash, then a deeper diagnosis to pinpoint what’s broken and why.

Two disciplined passes: stabilize cash fast, then diagnose root causes with deeper analysis.

In the first pass, prioritize financial analyses of the balance sheet, income statement, and working capital to protect liquidity, confirm data integrity, and stop immediate leaks.

In the second pass, expand into cost, expense, personnel, asset, and market reviews, diagnosing root causes by linking performance gaps to specific processes, behaviors, and decisions.

To get accurate information, build trust with employees, ask precise questions about workflow, handoffs, and constraints, and triangulate their input with system data to expose operational inefficiencies.

Bring in external specialists to challenge assumptions and validate findings. If managerial incompetence emerges, document it with evidence and craft a turnaround plan with targeted leadership, process, and control remedies.

Aligning Stakeholders and Building Commitment

Because turnarounds succeed only when people move in the same direction, align stakeholders early by defining who they are, what they care about, and how the plan affects them. Then communicate the reality of the situation with plain numbers, risks, and choices.

Use clear communication to explain the turnaround plan, the objectives, and the specific roles each group will play, so expectations are explicit and measurable. Invite stakeholders into planning sessions, gather their insights, and incorporate practical ideas to strengthen buy-in and foster collective responsibility.

Establish a cadence of brief progress reviews, share outcomes against milestones, and document decisions, which maintains momentum and signals accountability. Map interests to targets, address incentives and concerns directly, and resolve conflicts quickly, ensuring stakeholder engagement translates into aligned execution.

Stabilizing Cash Flow and Liquidity

When liquidity tightens, you stabilize cash first by stemming outflows, pulling forward inflows, and creating full visibility into your daily position so decisions match reality rather than hope.

Begin by renegotiating supplier terms to extend payables without damaging relationships, while accelerating debtor collections through tighter credit policies, early-payment incentives, and assertive follow-up.

Enforce immediate cost reductions by suspending discretionary spending, prioritizing payroll, critical inventory, and revenue-generating activities, and pausing nonessential projects.

Improve liquidity further by liquidating non-core or underperforming assets to meet urgent obligations and reduce carrying costs.

Strengthen financial controls with daily cash reports, a 13-week cash forecast, approval thresholds, and variance tracking, ensuring swift course corrections.

Where appropriate, use legal protections such as Safe Harbour to manage creditor pressure while stabilizing cash flow within your broader turnaround strategy.

Designing a Realistic Turnaround Plan

A credible turnaround plan translates urgency into a structured roadmap that connects short-term cash stabilization with medium-term balance-sheet repair and long-term profitability.

You begin by diagnosing root causes through a rigorous review of financial statements, operations, pricing, and customer profitability, then define priorities that restore positive cash flow while reshaping the cost base.

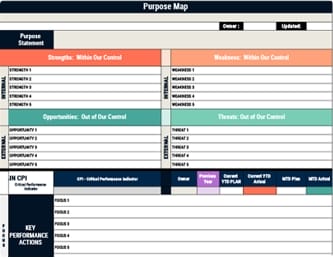

Convert insights into a sequenced plan that’s measurable: set KPIs for liquidity, margin, unit economics, and operating efficiency, and assign owners, timelines, and thresholds for escalation.

Engage stakeholders early—board, lenders, key customers, and employees—so they understand the goals, trade-offs, and milestones.

Specify actions for restructuring the business, including portfolio pruning, process fixes, and capability gaps, while reserving governance for weekly reviews and monthly replans.

Build a clear communication cadence that reports progress, flags risks, and drives accountability.

Restructuring Debt and Negotiating With Creditors

With a realistic turnaround plan in hand, you now need to secure the runway by reshaping obligations through disciplined debt restructuring and candid negotiations with creditors.

Start by conducting rigorous financial analysis, so you can present credible cash flow forecasts, debt schedules, and covenant headroom that justify restructuring debt within your broader turnaround strategy. Engage stakeholders early, align on goals, and designate a single point of contact to maintain transparent, timely communication.

- Stacked term sheets on a conference table, highlighting extended maturities and reduced rates.

- A cash flow graph bending upward after principal reductions take effect.

- A stakeholder map showing lenders, suppliers, and owners connected by clear commitments.

- A negotiation room with a shared dashboard, tracking concessions and milestones.

When negotiating with creditors, prioritize extensions, rate cuts, or principal haircuts. Sequence asks logically, and document contingencies to sustain cooperation.

Optimizing Operations for Profitability

Though cash is tight and time is short, you can restore profitability by stripping out inefficiency, sharpening focus, and installing discipline in how work gets done and measured.

Start by mapping processes end to end, remove bottlenecks and rework, and standardize best practices, because optimizing operations typically lifts productivity and can add 5% to 10% to profitability.

Prioritize your core business, shift resources to high-margin activities, and pursue cost reduction in non-essential functions without degrading quality.

Install rigorous financial controls, close the books faster, and build weekly dashboards so you can act on timely variances.

Track KPIs for throughput, unit cost, defect rate, overtime, and cash conversion, then adjust labor, suppliers, and schedules accordingly.

Review results monthly, lock in gains, and iterate.

Accelerating Revenue Without Extra Ad Spend

Because cash is scarce, accelerate revenue by monetizing what you already have: your customers, your channels, and your pricing levers.

Start by deepening customer relationships; segment buyers, identify high-value cohorts, and prompt repeat purchases with timely reorder nudges, simple bundles, and referral rewards.

Use personalized marketing to lift conversion without spend: targeted emails, lifecycle sequences, and win-back offers that speak to behavior, not averages.

Optimize pricing with surgical tests—A/B anchor prices, minimum viable discounts, and value-based tiers—to raise perceived value while protecting margin.

Form partnerships to cross-promote complementary offers, share lists ethically, and co-create bundles that expand reach.

- A cart filled with smart bundles replacing one-offs

- An email sequence guiding lapsed buyers back

- A price tag reframed to highlight value

- Two brands shaking hands, multiplying demand

Sustain momentum through consistent organic engagement on social, answering questions, spotlighting use cases, and driving low-friction sales.

Executing With Routines, KPIS, and Stage Gates

A disciplined operating cadence turns your turnaround from a plan into results, so set clear routines, tight KPIs, and firm stage gates that force regular, evidence-based decisions.

Start by defining performance metrics tied to your turnaround strategy—cash flow, gross margin, on-time delivery, and unit cost—then assign owners, targets, and review cycles.

Run daily huddles for frontline issues, weekly reviews for operational KPIs, and monthly governance to validate trends, ensuring you’re executing with speed and control.

Use stage gates as go/no-go checkpoints: confirm milestones, compare results to KPIs, and decide whether to proceed, pivot, or redesign work.

Build feedback loops with finance, operations, customers, and key suppliers at each gate to surface risks early.

Document decisions, track corrective actions, and reallocate resources quickly when metrics miss.

Sustaining Momentum and Measuring Progress Over 24 Months

If you want your turnaround to keep its pace over 24 months, set a rhythm that blends disciplined measurement with relentless communication, so people know what matters, when it’s due, and how progress will be judged.

You sustain momentum by aligning daily actions to clear short-, medium-, and long-term turnaround goals, then measuring progress with disciplined cadences. Review cash flow and sales daily, run weekly pipeline and cost huddles, and hold monthly KPI forums.

Use a Transformation Office to coordinate initiatives, enforce standards, and surface risks early. Deploy simple dashboards and advanced planning tools to automate tracking, enable scenario tests, and keep teams focused.

Stand up a Transformation Office to align initiatives, enforce standards, flag risks, and focus teams with smart dashboards and planning tools.

Continuously assess Key Performance Indicators for financial health, operational efficiency, and engagement, adjusting tactics quickly.

- Daily cash pulse, green/red visibility

- Weekly wins board, blockers removed

- Monthly KPI wall, trend lines clear

- TO war room, roadmap live

Frequently Asked Questions

How to Turnaround a Company That Is Failing?

Start by diagnosing root causes through cash flow, margin, and operational analyses, then triage issues by impact and speed.

Stabilize liquidity: cut nonessential spend, renegotiate terms, sell idle assets, and protect profitable customers.

Refocus on a profitable core, exit loss-making products, and redesign processes for throughput and quality.

Build a 24‑month plan with monthly KPIs, ownership, and milestones.

Communicate candidly, align incentives, manage talent, and iterate based on measured results.

What Are the 7 Proven Business Turnaround Strategy Steps?

Like a surgeon, you’ll follow seven precise steps: assess the current position thoroughly, diagnose root causes, engage stakeholders for alignment, stabilize cash and liquidity, craft a realistic plan prioritizing profitability over mere revenue, execute with disciplined timelines and owners, and review metrics regularly to adjust.

Set clear goals, motivate the team and owner, tighten costs, optimize pricing and product mix, improve operations and sales efficiency, and protect critical customers while exiting unprofitable segments.

How to Turn Around an Underperforming Business?

Start by diagnosing finances and operations, prioritizing cash flow, working capital, and KPI trends that expose losses.

Stabilize liquidity: slash nonessential spend, renegotiate payables, accelerate receivables, and protect core revenue.

Engage stakeholders early, align roles, and set clear 30-60-90 day goals.

Redesign the operating model, trim unprofitable products, and fix pricing.

Build a realistic roadmap with short-, mid-, and long-term targets, then execute rigorously, track metrics weekly, and adjust decisively.

What Are the 5 Step Processes for Turnaround Management?

Measure twice, cut once: you’ll follow five steps for turnaround management.

First, diagnose performance, identify KPIs, and uncover root causes.

Second, align stakeholders, set expectations, and secure commitment.

Third, craft a realistic plan that fixes cash flow now while mapping medium- and long‑term profitability.

Fourth, stabilize finances by cutting costs, restructuring debt, and generating operating cash.

Finally, execute relentlessly, review progress regularly, and adapt actions, keeping teams engaged and accountable.

Conclusion

In the next 24 months, you’ll spot distress early, diagnose root causes with data, align stakeholders, and stabilize cash quickly, because an ounce of prevention is worth a pound of cure. You’ll design a realistic plan, optimize operations, and accelerate revenue without extra ad spend, then execute through routines, KPIs, and stage gates. Keep evaluating, adjusting, and communicating, so you maintain momentum, build accountability, and convert short-term wins into durable profitability and a sustainable, resilient organization.