McKinsey reports resilient companies deliver 20% more total shareholder return in downturns, which tells you resilience isn’t optional. You sense shifts early, adapt with rapid tests, and realign operations in days, not quarters, then thrive by scaling what works and transform by redesigning your model before shocks force it. You’ll track demand signals, apply a Business Operating System, and use AI to compress cycle times, but the real edge comes from how you organize people and decisions next.

Key Takeaways

- Build resilience by strengthening balance sheets, preserving liquidity, and diversifying revenue to absorb shocks and sustain investment.

- Use a Sense–Adapt–Thrive–Transform framework to detect demand shifts, adjust in real time, scale wins, and redesign operating models.

- Develop a scenario playbook with thresholds, preplanned pricing, assortment, and cost actions, and rehearse pivots through regular reviews.

- Leverage technology and AI to convert signals into actions, optimize supply chains, personalize pricing, and automate decisions for speed and efficiency.

- Implement a structured BOS and people-first practices, with visual KPI tracking and feedback loops to align execution and drive continuous improvement.

Why Resilience Matters Now

Even as inflation, interest-rate swings, and uneven demand unsettle forecasts, resilience matters now because it equips your business to absorb shocks, make clear decisions under pressure, and move faster than competitors when conditions shift.

You need Business Resilience because economic uncertainty isn’t a brief storm; it’s a recurring climate, and companies that prepare outperform those that react.

Start by strengthening your balance sheet, preserving liquidity, and diversifying revenue so you can sustain operations and invest when others pull back.

Pair financial strength with innovation, testing new offerings and channels that hedge against demand swings.

Practice strategic resilience through scenario planning and risk mitigation, defining triggers, responses, and owners.

Add performance dashboards to continuously monitor progress and adapt actions as conditions change.

The Sense–Adapt–Thrive–Transform Framework

While volatility persists, the Sense–Adapt–Thrive–Transform framework from BCG gives you a practical sequence for steering through uncertainty and building durable advantage.

You start by sensing shifts in demand, pricing, and consumer behavior, using leading indicators and frontline feedback to spot risks and openings early. You then adapt to new conditions in real time, adjusting pricing, reallocating resources, and reinforcing supply chain resilience so critical operations keep pace with change.

Next, you thrive by scaling what works, investing in productivity, customer experience, and digital tools that convert disruption into measurable gains.

Thrive by scaling what works—boost productivity, elevate CX, and wield digital tools for measurable gains.

Finally, you transform by hardwiring a dynamic strategy mindset, redesigning operating models, and aligning capital and talent to long-term resilience and sustainability.

This staged approach lets you tailor decisions to your industry and region while compounding competitive advantage.

To sustain momentum, build mechanisms that tightly link strategic choices to execution by involving stakeholders early, aligning leadership on clear roles, and grounding plans in operational realities with measurable performance metrics.

Reading the Economy: Signals That Matter

Having a Sense–Adapt–Thrive–Transform playbook only works if you read the right signals, so start by tracking how consumers actually spend, not just what they say.

Watch real consumer spending per capita by category, because when shocks hit, buyers shift toward essentials and pull back on discretionary items, signaling where you must rebalance inventory, pricing, and promotions to protect Planning and Risk and strengthen Business Resiliency.

1) Track category-level spend: Identify trade-down patterns, pantry loading, and substitution to lower-cost brands, then adjust pack sizes, assortments, and price points to hold share and margin.

2) Measure value and trust: Monitor brand switching rates and review data from loyalty programs to refine offers that defend perceived value.

3) Refresh weekly: Build rolling dashboards, set trigger thresholds, and predefine actions so you can pivot quickly as sentiment flips.

Strengthen both vertical and horizontal coordination so frontline actions reflect strategy, because balanced organizational alignment boosts engagement, improves decision-making, and drives faster revenue growth.

Lessons From 50 Years of Consumer Behavior

Because five decades of data tell a consistent story, you should plan for consumer priorities to pivot quickly when the economy jolts, with essentials crowding out many discretionary buys and brand loyalty reshaped by perceived value and trust.

Build Resilience by mapping your offer set into “need-to-haves,” “nice-to-haves,” and “affordable luxuries,” then predefine pricing, pack sizes, and promotions that protect basket value without eroding margin.

Expect response speed to track shock magnitude, so stage triggers that accelerate changes in assortment, inventory, and media mix when indicators spike.

Reinforce your business with trust signals—reliable availability, honest pricing, and clear quality proofs—since value and credibility recast loyalty during stress.

Monitor sentiment, trade-down patterns, and channel shifts weekly, and rehearse quick pivots that prioritize essentials while preserving selective indulgence.

To sustain cohesion across teams during fast pivots, anchor goals and execution with OKRs, ensuring vertical, horizontal, and strategic alignment that keeps assortment, pricing, and communications in sync.

Scenario Playbook: From Soft Landings to Shocks

Even in stable times, you need a Scenario Playbook that spells out how you’ll operate across a soft landing, a slowdown, a recession, and a sudden shock, with clear triggers, actions, and owners.

Build it to drive agility, speed decisions, and convert real-time signals into disciplined responses. Use scenario planning and stress testing to map vulnerabilities, estimate impacts on demand and cost, and predefine moves that protect cash and capture share. Companies that align strategy and execution—like Tesla, Airbnb, and PayPal—show that disciplined, cross-functional playbooks turn signals into results, as seen in Tesla’s integration of strategic alignment with execution across teams.

- Define scenarios and thresholds: tie macro and consumer indicators to explicit triggers, then assign owners for each lever.

- Pre-plan actions: set playcards for pricing, assortment, channels, and cost controls, calibrated by severity, duration, and recovery paths.

- Institutionalize cadence: run war-room reviews, refresh assumptions with historical insights, and rehearse pivots so teams execute on signal, not debate.

Data-Driven Actions for Retailers and Manufacturers

While uncertainty persists, you can turn real-time consumer signals into concrete moves by pairing fast-moving consumer goods data with disciplined scenario planning, then acting on what shoppers actually do rather than what forecasts imply.

Use FMCG velocity to read demand shifts quickly, then make decisions on inventory, pricing, and promotions with data-driven insights rather than instinct.

Prioritize “need-to-haves,” since history shows they hold steady, while “nice-to-haves” often drop, and rebalance space, sourcing, and safety stock accordingly.

Track pantry loading to adjust case pack sizes and replenishment cadence, preventing out-of-stocks and costly overstocks.

Monitor private label switching to recalibrate value tiers, bundle offers, and trade-down paths without eroding margins.

Refresh media and in-store messaging to reflect frugality signals, aligning creative, timing, and channels with observed behaviors.

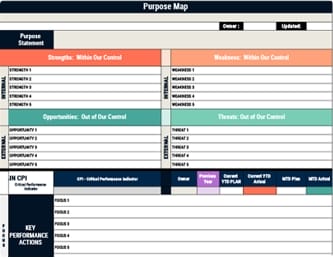

Anchor these moves in a CPI→KPI→KPA loop by defining a few Critical Performance Indicators, aligning supporting KPIs, and enforcing daily KPAs so actions consistently translate data into results.

Tech and AI as Force Multipliers for Resilience

You’ve grounded decisions in real shopper behavior; now put technology to work as a force multiplier that scales those practices across your business.

Use tech transformation to turn data into action faster, automate routine work, and sharpen decisions under pressure. AI systems scan vast data streams, surface patterns you’d miss, and guide swift responses to market shifts, while automation boosts operational efficiency and frees teams for higher‑value tasks.

1) Deploy AI decision engines that detect demand shifts, price sensitivity, and churn risks, then recommend targeted offers and inventory moves in near real time.

2) Automate supply chain planning with AI to optimize inventory levels, reduce carrying costs, and reroute around disruptions with dynamic forecasting.

3) Integrate AI into service channels to read sentiment, adjust messaging, and prioritize retention efforts during uncertainty.

A structured BOS clarifies roles, streamlines processes, and aligns teams, making AI adoption far more effective by anchoring it in documented processes and continuous improvement.

Building a People-First, Future-Ready Organization

Because resilience starts with people, build a future‑ready organization by putting employees’ well‑being, growth, and clarity first, then aligning structures and practices to sustain that commitment under pressure. Use a people-first approach to reduce a high turnover rate, strengthen trust, and keep institutional knowledge. Define clear goals, share progress, and explain financial realities, because transparency sustains morale and productivity when conditions shift. Invest in leadership development so managers coach, align priorities, and model accountability, turning uncertainty into coordinated execution. Create flexible work options—remote, hybrid, and adaptable staffing—so you can scale capacity quickly while protecting continuity and efficiency. Establish consistent feedback loops, act on survey insights, and run small experiments that refine workflows. Track outcomes with simple metrics, adjust policies, and reinforce behaviors that compound resilience. Add visual management boards to centralize KPIs with clear, color‑coded indicators so teams can quickly spot deviations and take timely, data‑driven action.

Frequently Asked Questions

How Can Resilience Be Built in Times of Uncertainty?

You build resilience by adopting a dynamic strategy mindset: map scenarios, quantify risks, and pre-plan triggers for action.

Strengthen your balance sheet, preserve liquidity, and prioritize investments that drive innovation and efficiency.

Monitor consumer behavior and leading market signals weekly, then adjust pricing, inventory, and marketing swiftly.

Establish cross-functional war rooms to accelerate decisions, clarify roles, and remove bottlenecks.

Finally, run small experiments, measure outcomes rigorously, and scale what works while sunsetting underperforming initiatives.

What Are the Four Elements of the Resilience Framework?

The four elements are sense, adapt, thrive, and transform.

You first sense early market and customer signals, using data and feedback to shape timely choices.

You then adapt operations and models, reallocating resources and adjusting processes quickly.

Next, you thrive by stabilizing core performance while pursuing targeted growth opportunities.

Finally, you transform by reimagining strategy, investing in innovation, and building capabilities that make your organization more resilient to future shocks and structural shifts.

How Does Economic Uncertainty Affect a Business?

When uncertainty hits, you’re skating on thin ice. Economic swings shift consumers toward essentials, so you’ll see weaker demand for discretionary products, tighter cash flow, and delayed investments.

Inflation and rates raise costs and borrowing hurdles, while tariffs disrupt supply chains and pricing.

You should monitor signals and sentiment closely, adjust pricing and assortment, safeguard liquidity, and prioritize flexible operations and innovation, so you can pivot quickly and capture opportunities while limiting downside risk.

What Are the 4 P’s of Business Continuity?

The 4 P’s of business continuity are People, Processes, Products, and Partners.

You train and equip people to act under pressure, maintain clear roles, and guarantee cross-coverage.

You document and test processes, prioritize critical workflows, and build contingencies.

You adapt products and services to meet shifting demand and supply limits.

You manage partners by mapping dependencies, strengthening communications, and establishing backup suppliers and service agreements, so operations continue despite disruptions.

Conclusion

You can’t control the economy, but you can control your response: sense shifts, adapt operations, thrive through disciplined execution, and transform with purpose. Think of a sailor trimming sails before a squall; a retailer that cut SKUs by 20% saw stockouts fall 35% and cash flow stabilize, proving small pivots compound. Use real-time signals, scenario playbooks, and AI-enabled ops within a people-first operating system, then track outcomes relentlessly so decisions stay aligned, accountable, and resilient.